Realty Income Announces Dividend Increase Of 5.1%

SAN DIEGO, Nov. 16, 2021

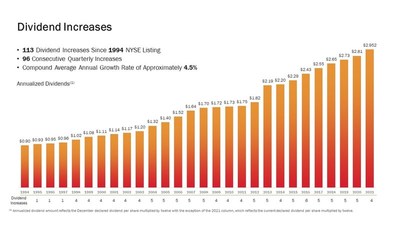

SAN DIEGO, Nov. 16, 2021 /PRNewswire/ -- Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced its Board of Directors has declared an increase in the company’s common stock monthly cash dividend to $0.246 per share from $0.236 per share. The dividend is payable on December 15, 2021 to shareholders of record as of December 1, 2021. This is the 113th dividend increase since Realty Income’s listing on the NYSE in 1994. The ex-dividend date for December’s dividend is November 30, 2021. The new monthly dividend represents an annualized dividend amount of $2.952 per share as compared to the current annualized dividend amount of $2.832 per share.

"Following the closing of our recent merger, our continued operational success and favorable outlook has allowed us to increase the dividend for the 113th time since our company’s public listing in 1994," said Sumit Roy, President and Chief Executive Officer of Realty Income. "We remain committed to our company’s mission to invest in people and places to deliver dependable monthly dividends that increase over time. With the payment of the December dividend, shareholders will realize a 5.1% increase in the amount of the dividend as compared to the same month in 2020."

About the Company

Realty Income, The Monthly Dividend Company®, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats® index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from almost 11,000 real estate properties owned under long-term lease agreements with our commercial clients. To date, the company has declared 617 consecutive common stock monthly dividends throughout its 52-year operating history and increased the dividend 113 times since Realty Income’s public listing in 1994 (NYSE: O). Additional information about the company can be obtained from the corporate website at www.realtyincome.com.

Forward-Looking Statements

Statements in this press release that are not strictly historical are "forward-looking" statements. Forward-looking statements involve known and unknown risks, which may cause our actual future results to differ materially from expected results. These risks include, among others, general economic conditions, domestic and foreign real estate conditions, client financial health, the availability of capital to finance planned growth, volatility and uncertainty in the credit markets and broader financial markets, changes in foreign currency exchange rates, property acquisitions and the timing of these acquisitions, the spin-off of the office properties of Realty Income, Inc., and any effects thereof, including the anticipated benefits therefrom, the anticipated benefits of the completed merger with VEREIT, charges for property impairments, the effects of the COVID-19 pandemic and the measures taken to limit its impact, the effects of pandemics or global outbreaks of contagious diseases or fear of such outbreaks, the ability of clients to adequately manage their properties and fulfill their respective lease obligations to Realty Income, and the outcome of any legal proceedings to which Realty Income is a party. Consequently, forward-looking statements should be regarded solely as reflections of Realty Income’s current operating plans and estimates. Actual operating results may differ materially from what is expressed or forecast in this press release. Realty Income does not undertake any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

SOURCE Realty Income Corporation

View original content: Businesswire

Realty Income Corp

Symbol: O

CIK: 726728

Exchange: NYSE

Founded: 1969 (56 years)

Type of REIT: Equity REIT

Listing Status: Public

Market Capitalization: Large-Cap

REIT Sector: Retail, Industrial, Office, Specialty

REITRating is REITNote's Real Estate Investment Trust industry-specific rating and ranking system. The overall score is out of ten points, with ten being the best score.

Latest Price: $53.08

High: $53.14

Low: $52.38

Open: $52.69

Previous Close: $52.45

Volume: 2,670,607

52-Week High: $60.58

52-Week Low: $43.10

Last updated: 2025-03-30 - v1.3