Equity Commonwealth | REIT Profile

Symbol: EQC

CIK: 803649

Exchange: NYSE

Preferred Stock: EQC-D

Founded: 1986 (39 years)

HQ: Chicago, IL, United States

Type of REIT: Equity REIT

Listing Status: Public

Market Capitalization: Micro-Cap

REIT Sector: Office

Internally Managed REIT

See EQC on Yahoo Finance

See EQC on SEC.gov

Stock Chart [U.S. Markets Closed]

REITMovers

REITMovers tracks the stock price and other indicators for all US REITs tracked by REITNotes during normal trading hours. This data is updated every 4 minutes during normal trading hours. Note: All prices have a 15 minute delay.

| Latest Price | High | Low | Open | Previous Close | Volume | Change $ | Change % |

|---|---|---|---|---|---|---|---|

| $1.59 | $1.60 | $1.59 | $1.59 | $1.59 | 177,249 | N/A | N/A |

Last update: 2025-04-17 12:57:23 PST

Dividend of Trading Day 2025-04-18 [Dividends Currently Suspended]

Annualized Dividend:

Dividend Yield (TTM):

Annualized Dividend (TTM):

Ex-Dividend Date: 2025-04-11

Dividend Date: 2024-12-06

Dividend Frequency: Quarterly

REITBOT™ Alert

Dividends have been suspended for this REIT.

*The forward annualized dividend and dividend yield are based on the most recent dividend value paid by the REIT. The REIT may have already announced their next upcoming dividend value, which may be different from previously paid dividend value. It is recommended to check the REIT's website and dividend announcements for the latest information on upcoming dividends and changes. This graph does not include extraordinary dividend.

Latest REIT Press Releases

- Equity Commonwealth - Equity Commonwealth Declares Its Final Cash Liquidating Distribution of $1.60 Per Common Share and Its Plan to Delist from NYSE - Tue, 01 Apr 2025 20:15:18 UTC

- Equity Commonwealth - Equity Commonwealth Completes Sale of 1225 Seventeenth Street Plaza and Reports 2024 Results - Thu, 27 Feb 2025 11:45:34 UTC

- Equity Commonwealth - Equity Commonwealth Agrees to Sell 1225 Seventeenth Street Plaza - Mon, 10 Feb 2025 21:18:21 UTC

- Equity Commonwealth - Equity Commonwealth Announces Tax Treatment of 2024 Distributions - Thu, 30 Jan 2025 21:20:21 UTC

- Equity Commonwealth - Equity Commonwealth Completes Sale of 1250 H Street - Tue, 26 Nov 2024 21:15:30 UTC

Funds From Operations (FFO)

FFO Amount and Payout Ratio

Below are the FFO amounts, dividends, and payout ratios for the last two quarters for EQC.

| Year | Quarter | Type | Amount | Dividend Paid | Payout Ratio |

|---|---|---|---|---|---|

| 2024 | Q3 | Normalized FFO | $--- | $--- | ---% |

| 2024 | Q3 | FFO | $--- | $--- | ---% |

| 2024 | Q2 | Normalized FFO | $--- | $--- | ---% |

| 2024 | Q2 | FFO | $--- | $--- | ---% |

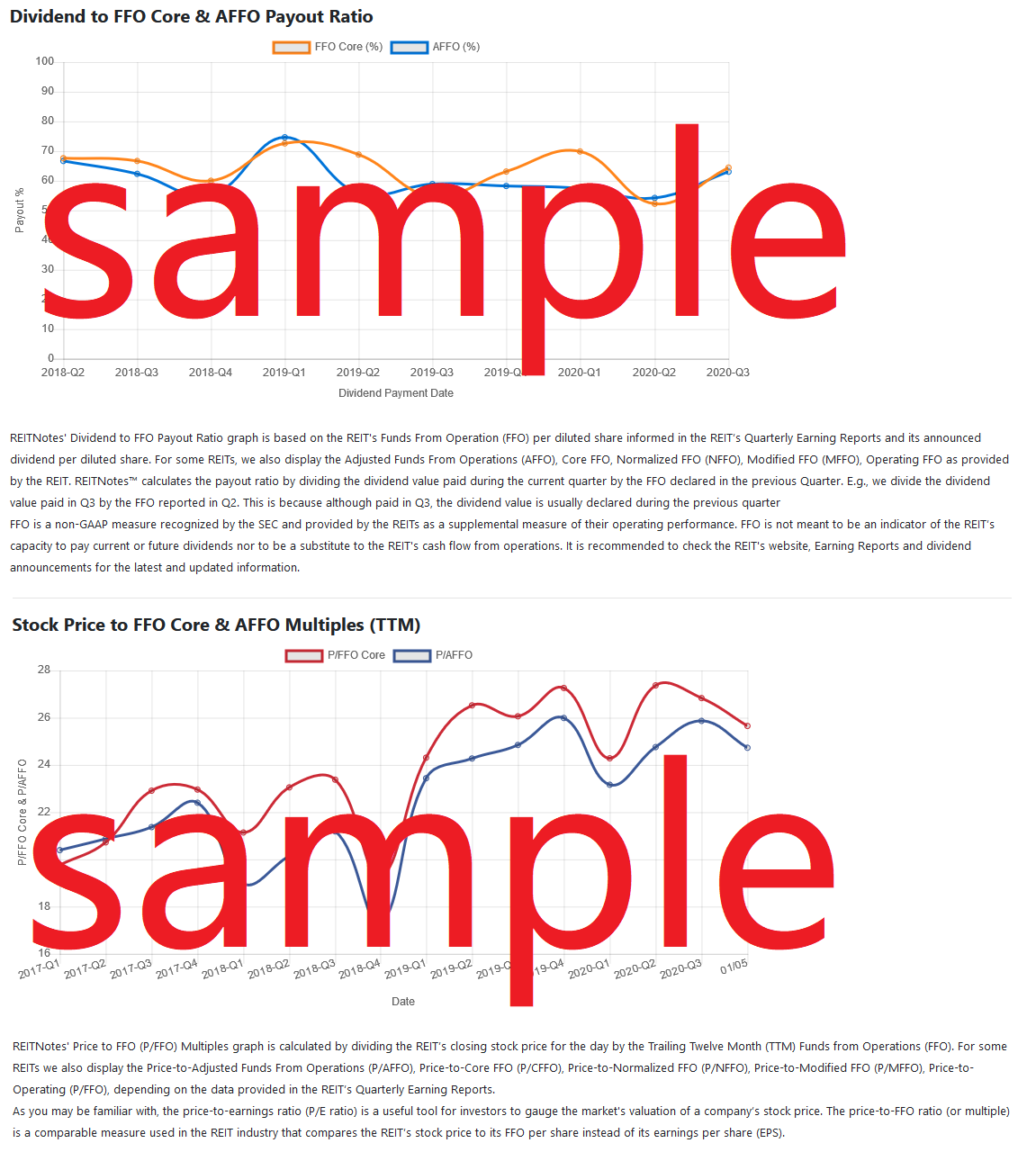

REITNotes uses the REIT's Funds From Operation (FFO) per diluted share informed in the REIT’s Quarterly Earning Reports and its announced dividend per diluted share. For some REITs, we also display the Adjusted Funds From Operations (AFFO), Core FFO, Normalized FFO (NFFO), Modified FFO (MFFO), Operating FFO as provided by the REIT. REITNotes™ calculates the payout ratio by dividing the dividend value paid during the current quarter by the FFO declared in the previous Quarter. E.g., we divide the dividend value paid in Q3 by the FFO reported in Q2. This is because although paid in Q3, the dividend value is usually declared during the previous quarter. FFO is a non-GAAP measure recognized by the SEC and provided by the REITs as a supplemental measure of their operating performance. FFO is not meant to be an indicator of the REIT’s capacity to pay current or future dividends nor to be a substitute to the REIT's cash flow from operations. It is recommended to check the REIT's website, Earning Reports and dividend announcements for the latest and updated information.

Key Stats of Trading Day 2025-04-18

EBITDA: $-5,107,200

P/E Ratio: 4.24

PEG Ratio: N/A

Book Value: 21.34

Dividend Per Share: N/A

EPS: 0.38

Revenue Per Share TTM: $0.54

ProfitMargin: 66.00%

Operating Margin TTM: -42.00%

Return on Equity TTM: 2.10%

Revenue TTM: $57,570,000

Gross Profit TTM: $30,519,600

Diluted EPS TTM: $0.38

Quarterly Earnings Growth YOY: 66.70%

Quarterly Revenue Growth YOY: -8.00%

Trailing P/E: 4.24

Forward P/E: N/A

Beta: 0.69

Price to Book Ratio: 0.97

EV to Revenue: 0.21

EV to EBITDA: 56.98x

Shares Outstanding: 107,421,000

52 Week High: $21.00

52 Week Low: $1.40

50 Day Moving Average: $1.64

200 Day Moving Average: $11.81

Properties Owned by EQC

Sample of REIT’s Properties. Image Source - REIT’s website

Occupancy Rate

REIT Simulation

Below is a simulation of how much money you would have made in dividends, and how much the shares would be worth had you purchased them 1 year ago for the amounts below.

| With $1,000 USD | With $500 USD | With $250 USD | With $100 USD | With $50 USD | |

|---|---|---|---|---|---|

| Initial investment | @ $32.67 per share you would have been able to buy 30 shares of EQC on 2024-04-18 costing $980.10 | @ $32.67 per share you would have been able to buy 15 shares of EQC on 2024-04-18 costing $490.05 | @ $32.67 per share you would have been able to buy 7 shares of EQC on 2024-04-18 costing $228.69 | @ $32.67 per share you would have been able to buy 3 shares of EQC on 2024-04-18 costing $98.01 | @ $32.67 per share you would have been able to buy 1 shares of EQC on 2024-04-18 costing $32.67 |

| Current worth | On 2024-07-05 these 30 shares would be worth $574.50 @ $19.15 | On 2024-07-05 these 15 shares would be worth $287.25 @ $19.15 | On 2024-07-05 these 7 shares would be worth $134.05 @ $19.15 | On 2024-07-05 these 3 shares would be worth $57.45 @ $19.15 | On 2024-07-05 these 1 shares would be worth $19.15 @ $19.15 |

| Dividends earned | $0.00 in dividends would have been earned since 2024-04-18 with 30 shares. | $0 in dividends would have been earned since 2024-04-18 with 15 shares. | $0.00 in dividends would have been earned since 2024-04-18 with 7 shares. | $0.00 in dividends would have been earned since 2024-04-18 with 3 shares. | $0.00 in dividends would have been earned since 2024-04-18 with 15 shares. |

| Net (gain / loss)* | -405.60 USD | -202.80 USD | -94.64 USD | -40.56 USD | -13.52 USD |

| ROI** | -41.38% | -41.38% | -41.38% | -41.38% | -41.38% |

*Net (Gains/Loss): Includes the stock price (appreciate or depreciate ) + dividends earned during period held. Stock prices based on closing price for the date. **ROI: Is based on the Net (gain/loss) divided by the initial investment value. Note: Past performance is no guarantee of future results. This is a high-level simulation and does not account for many factors such as inflation and taxes so we cannot guarantee the accuracy of this simulation.

Dividend History [Dividends Currently Suspended]

Below are the most recent cash dividends paid by EQC. The percent difference from one dividend payment to the next has also been calculated for your convenience. Dividends flagged as [E] are extraordinary dividend payments.

| Symbol | Ex Date | Cash Amount | Change in Dividend | Declaration Date | Record Date | Payment Date |

|---|---|---|---|---|---|---|

| EQC | 2023-02-22 | 4.250 | 325.00% | 2023-02-13 | 2023-02-23 | 2023-03-09 |

| EQC | 2022-09-28 | 1.000 | -71.43% | 2022-09-08 | 2022-09-29 | 2022-10-18 |

| EQC | 2020-09-30 | 3.500 | --- | 2020-09-16 | 2020-10-01 | 2020-10-20 |

| EQC | 2019-10-04 | 3.500 | --- | 2019-09-24 | 2019-10-07 | 2019-10-23 |

| EQC | 2019-04-19 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2019-01-09 | 0.000 | -100.00% | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2018-10-08 | 2.500 | --- | 2018-09-26 | 2018-10-09 | 2018-10-23 |

| EQC | 2018-10-05 | 2.500 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2018-07-24 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2018-04-19 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2018-01-09 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2017-10-05 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2017-07-24 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2017-04-19 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2017-01-09 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2016-10-05 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2016-07-24 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2016-04-19 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2016-01-09 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| EQC | 2015-10-05 | 0.000 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

Financial Statements Overview

Balance Sheet | Quarterly

See Annual Balance Sheet | See Quarterly Balance Sheet

Income Statement | Quarterly

See Annual Income Statement | See Quarterly Income Statement

Cash Flow | Quarterly

See Annual Cash Flow | See Quarterly Cash Flow

Related Information

| Material | Source | Description |

|---|---|---|

| Equity Commonwealth Continues To Sell Off Assets | BISNOW | Equity Commonwealth has been in sell mode the past three years and now sits on $2.1B in cash from disposing of assets in a strong market. And it does not look like Sam Zell, David Helfand and company are done selling off assets. Crain's Chicago Business reports that Equity Commonwealth is seeking a buyer for one of the O'Hare submarket's most visible office complexes. |

| Equity Commonwealth Announces Voting Results of Special Shareholder Meeting and Payment of Liquidation Preference for Series D Preferred Shares (2024-11-12) | Equity Commonwealth | CHICAGO--(BUSINESS WIRE)-- Equity Commonwealth (NYSE: EQC) (the “Company”) held a special meeting of shareholders (the “Special Meeting”) today, November 12, 2024. At the Special Meeting, the Company’s shareholders (i) approved the Plan of Sale and Dissolution of the Company (the “Plan of Sale”), including the wind-down and complete liquidation of the Company, and the dissolution and termination of the Company, including the establishment of a Liquidating Entity, as defined in the definitive proxy statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on October 2, 2024, and (ii) approved, on a non-binding advisory basis, the compensation that may become payable by the Company to its named executive officers in connection with the Plan of Sale. The final voting results for each proposal will be made available in a Current Report on Form 8-K to be filed by the Company with the SEC on or about November 13, 2024. |

Related REITs

| REIT | REITRating™ Score | Exchange | Market Capitalization | Sector | Country |

|---|---|---|---|---|---|

| CIM Commercial Trust Corp (CMCT) | 5.7 | NASDAQ | Micro-Cap | Office Hotel Residential | United States |

| City Office REIT Inc (CIO) | 5.5 | NYSE | Micro-Cap | Office | United States |

| Franklin Street Properties Corp. (FSP) | 4.1 | NYSE | Micro-Cap | Office | United States |

| Generation Income Properties Inc. (GIPR) | 2.9 | NASDAQ | Micro-Cap | Retail Office Industrial | United States |

| Gyrodyne Company of America, Inc. (GYRO) | N/A | NASDAQ | Micro-Cap | Industrial Office Health Care Diversified | United States |

Last updated: 2025-04-18 - v5.8