Government Properties Income Trust, Inc. [Ticker Symbol has Changed] | REIT Profile

Symbol: GOV

new symbol: OPI

Exchange: NASDAQ

Founded: 2009

HQ: Newton, MA, United States

Type of REIT: Equity REIT

Listing Status: Public

Market Capitalization: Small-Cap

REIT Sector: Office

Externally Managed REIT

GOV is a real estate investment trust, or REIT, which primarily owns properties located throughout the United States that are majority leased to the U.S. Government and other government tenants and office properties in the metropolitan Washington, D.C. market area that are leased to government and private sector tenants. GOV is managed by the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR), an alternative asset management company that is headquartered in Newton, Massachusett

Stock Chart

Dividend of Trading Day

Annualized Dividend: $0*

Dividend Yield (TTM): 0%

Annualized Dividend (TTM): $0

Ex-Dividend Date:

Dividend Date:

Dividend Frequency: Quarterly

*The forward annualized dividend and dividend yield are based on the most recent dividend value paid by the REIT. The REIT may have already announced their next upcoming dividend value, which may be different from previously paid dividend value. It is recommended to check the REIT's website and dividend announcements for the latest information on upcoming dividends and changes. This graph does not include extraordinary dividend.

Funds From Operations (FFO)

FFO Amount and Payout Ratio

Below are the FFO amounts, dividends, and payout ratios for the last two quarters for GOV.

| Year | Quarter | Type | Amount | Dividend Paid | Payout Ratio |

|---|---|---|---|---|---|

| 2018 | Q3 | Normalized FFO | $--- | $--- | ---% |

| 2018 | Q3 | FFO | $--- | $--- | ---% |

| 2018 | Q2 | FFO | $--- | $--- | ---% |

| 2018 | Q2 | Normalized FFO | $--- | $--- | ---% |

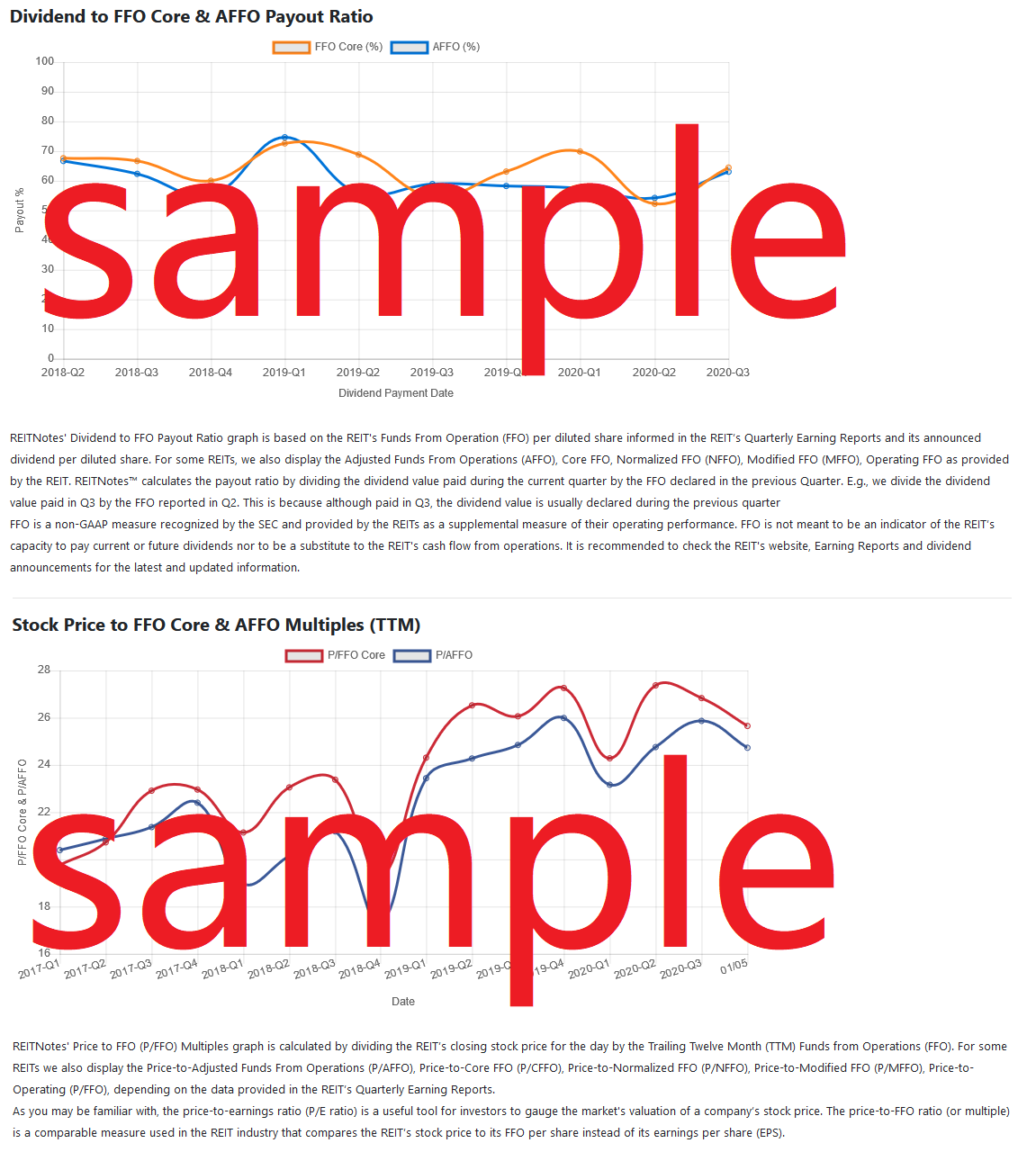

REITNotes uses the REIT's Funds From Operation (FFO) per diluted share informed in the REIT’s Quarterly Earning Reports and its announced dividend per diluted share. For some REITs, we also display the Adjusted Funds From Operations (AFFO), Core FFO, Normalized FFO (NFFO), Modified FFO (MFFO), Operating FFO as provided by the REIT. REITNotes™ calculates the payout ratio by dividing the dividend value paid during the current quarter by the FFO declared in the previous Quarter. E.g., we divide the dividend value paid in Q3 by the FFO reported in Q2. This is because although paid in Q3, the dividend value is usually declared during the previous quarter. FFO is a non-GAAP measure recognized by the SEC and provided by the REITs as a supplemental measure of their operating performance. FFO is not meant to be an indicator of the REIT’s capacity to pay current or future dividends nor to be a substitute to the REIT's cash flow from operations. It is recommended to check the REIT's website, Earning Reports and dividend announcements for the latest and updated information.

Key Stats of Trading Day

EBITDA: $0

P/E Ratio: 0.00

PEG Ratio: 0.00

Book Value: 0.00

Dividend Per Share: $0.00

EPS: 0.00

Revenue Per Share TTM: $0.00

ProfitMargin: 0.00%

Operating Margin TTM: 0.00%

Return on Equity TTM: 0.00%

Revenue TTM: $0

Gross Profit TTM: $0

Diluted EPS TTM: $0.00

Quarterly Earnings Growth YOY: 0.00%

Quarterly Revenue Growth YOY: 0.00%

Trailing P/E: 0.00

Forward P/E: 0.00

Beta: 0.00

Price to Book Ratio: 0.00

EV to Revenue: 0.00

EV to EBITDA: 0.00x

Shares Outstanding: 0

52 Week High: $0.00

52 Week Low: $0.00

50 Day Moving Average: $0.00

200 Day Moving Average: $0.00

Properties Owned by GOV

Sample of REIT’s Properties. Image Source - REIT’s website

Dividend History

Below are the most recent cash dividends paid by GOV. The percent difference from one dividend payment to the next has also been calculated for your convenience. Dividends flagged as [E] are extraordinary dividend payments.

| Symbol | Ex Date | Cash Amount | Change in Dividend | Declaration Date | Record Date | Payment Date |

|---|---|---|---|---|---|---|

| GOV | 2018-10-26 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2018-07-27 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2018-04-27 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2018-01-26 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2017-10-20 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2017-07-20 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2017-04-19 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2017-01-19 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2016-10-19 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2016-07-20 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2016-04-21 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2016-01-20 | 0.430 | 235.94% | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2015-12-15 | 0.128 | -70.23% | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2015-10-21 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2015-07-22 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2015-04-22 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2015-01-21 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2014-10-22 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2014-07-23 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

| GOV | 2014-04-23 | 0.430 | --- | 0000-00-00 | 0000-00-00 | 0000-00-00 |

Balance Sheet | Quarterly

See Annual Balance Sheet | See Quarterly Balance Sheet

Income Statement | Quarterly

See Annual Income Statement | See Quarterly Income Statement

Cash Flow | Quarterly

See Annual Cash Flow | See Quarterly Cash Flow

Related Information

| Material | Source | Description |

|---|---|---|

| Government Properties Income Trust Named Top 10 REIT at Dividend Channel With 7.81% Yield | Forbes.com | Government Properties Income Trust (NYSE: GOV) has been named as a Top 10 Real Estate Investment Trust (REIT), according to Dividend Channel, which published its most recent ''DividendRank'' report. |

| Government Properties Income Trust and Select Income REIT Announce Agreement to Merge | MarketWatch | Government Properties Income Trust and Select Income REIT Announce Agreement to Merge; Government Properties Income Trust to Change its Name to “Office Properties Income Trust†|

REITProperty

| Name | Type | Address | City | State |

|---|---|---|---|---|

| Clayton Street | Office | 131 Clayton Street | Montgomery | AL |

| Carmichael Road | Office | 4344 Carmichael Road | Montgomery | AL |

| North 28th Avenue | Office | 15451 North 28th Avenue | Phoenix | AZ |

Related REITs

| REIT | REITRating™ Score | Exchange | Market Capitalization | Sector | Country |

|---|---|---|---|---|---|

| Vornado Realty Trust (VNO) | 5.9 | NYSE | Mid-Cap | Diversified Residential Office | United States |

| Highwoods Properties, Inc. (HIW) | 7.1 | NYSE | Mid-Cap | Office Industrial Retail | United States |

| Brandywine Realty Trust (BDN) | 5.7 | NYSE | Small-Cap | Office Residential | United States |

| LXP Industrial Trust (LXP) | 8.2 | NYSE | Mid-Cap | Industrial | United States |

| Franklin Street Properties Corp. (FSP) | 4.1 | NYSE | Micro-Cap | Office | United States |

Last updated: 2025-04-17 - v5.8