Kilroy Realty Corp, Inc. | REIT Profile

Symbol: KRC

CIK: 1025996

Exchange: NYSE

Founded: 1996 (29 years)

HQ: Los Angeles, CA, United States

Type of REIT: Equity REIT

Listing Status: Public

Market Capitalization: Mid-Cap

REIT Sector: Office, Residential

See KRC on Yahoo Finance

See KRC on SEC.gov

Kilroy Realty Corporation (KRC), a publicly traded real estate investment trust and member of the S&P MidCap 400 Index, is one of the West Coast's premier landlords. The company has over 70 years of experience developing, acquiring and managing office and mixed-use real estate assets. The company provides physical work environments that foster creativity and productivity and serves a broad roster of dynamic, innovation-driven tenants, including technology, entertainment, digital media and health care companies. At June 30, 2017, the company's stabilized portfolio totaled approximately 14.4 million square feet of office space and 200 residential units located in the coastal regions of Los Angeles, Orange County, San Diego, the San Francisco Bay Area and Greater Seattle. In addition, KRC had four projects totaling approximately 1.8 million square feet of office space, 237 residential units and 96,000 square feet of retail space under construction.

Stock Chart

REITMovers

REITMovers tracks the stock price and other indicators for all US REITs tracked by REITNotes during normal trading hours. This data is updated every 4 minutes during normal trading hours. Note: All prices have a 15 minute delay.

| Latest Price | High | Low | Open | Previous Close | Volume | Change $ | Change % |

|---|---|---|---|---|---|---|---|

| $31.23 | $32.09 | $30.96 | $31.51 | $31.37 | 1,933,564 | -$0.14 | -0.45% |

Last update: 2025-04-17 12:58:16 PST

REITRating™ Trend

REITRating™ is REITNotes' Real Estate Investment Trust industry-specific rating and ranking system. The overall score is out of ten points, with ten being the best score. See score breakdown. The graph below plots the overall REITRating™ score for the last trading days. See complete trend.

Dividend of Trading Day 2025-04-17

Annualized Dividend: $2.16*

Dividend Yield (TTM): 6.8%

Annualized Dividend (TTM): $2.16

Ex-Dividend Date: 2025-03-31

Dividend Date: 2025-04-09

Dividend Frequency: Quarterly

*The forward annualized dividend and dividend yield are based on the most recent dividend value paid by the REIT. The REIT may have already announced their next upcoming dividend value, which may be different from previously paid dividend value. It is recommended to check the REIT's website and dividend announcements for the latest information on upcoming dividends and changes. This graph does not include extraordinary dividend.

Latest REIT Press Releases

- Kilroy Realty - Kilroy Realty Publishes Fourteenth Annual Sustainability Report, Announces 2030 Sustainability Goals - Fri, 11 Apr 2025 13:01:00 UTC

- Kilroy Realty - Kilroy Realty Announces Retirement of Board Director Scott Ingraham - Thu, 10 Apr 2025 20:37:23 UTC

- Kilroy Realty - Kilroy Realty Declares Quarterly Dividend - Tue, 25 Feb 2025 21:05:29 UTC

- Kilroy Realty - Kilroy Realty Corporation Reports Fourth Quarter and Full Year Financial Results - Mon, 10 Feb 2025 21:49:31 UTC

- Kilroy Realty - Kilroy Realty Announces 2024 Tax Treatment of Its Dividend Distributions - Thu, 23 Jan 2025 22:44:22 UTC

Funds From Operations (FFO)

FFO Amount and Payout Ratio

Below are the FFO amounts, dividends, and payout ratios for the last two quarters for KRC.

| Year | Quarter | Type | Amount | Dividend Paid | Payout Ratio |

|---|---|---|---|---|---|

| 2024 | Q4 | FFO | $--- | $--- | ---% |

| 2024 | Q3 | FFO | $--- | $--- | ---% |

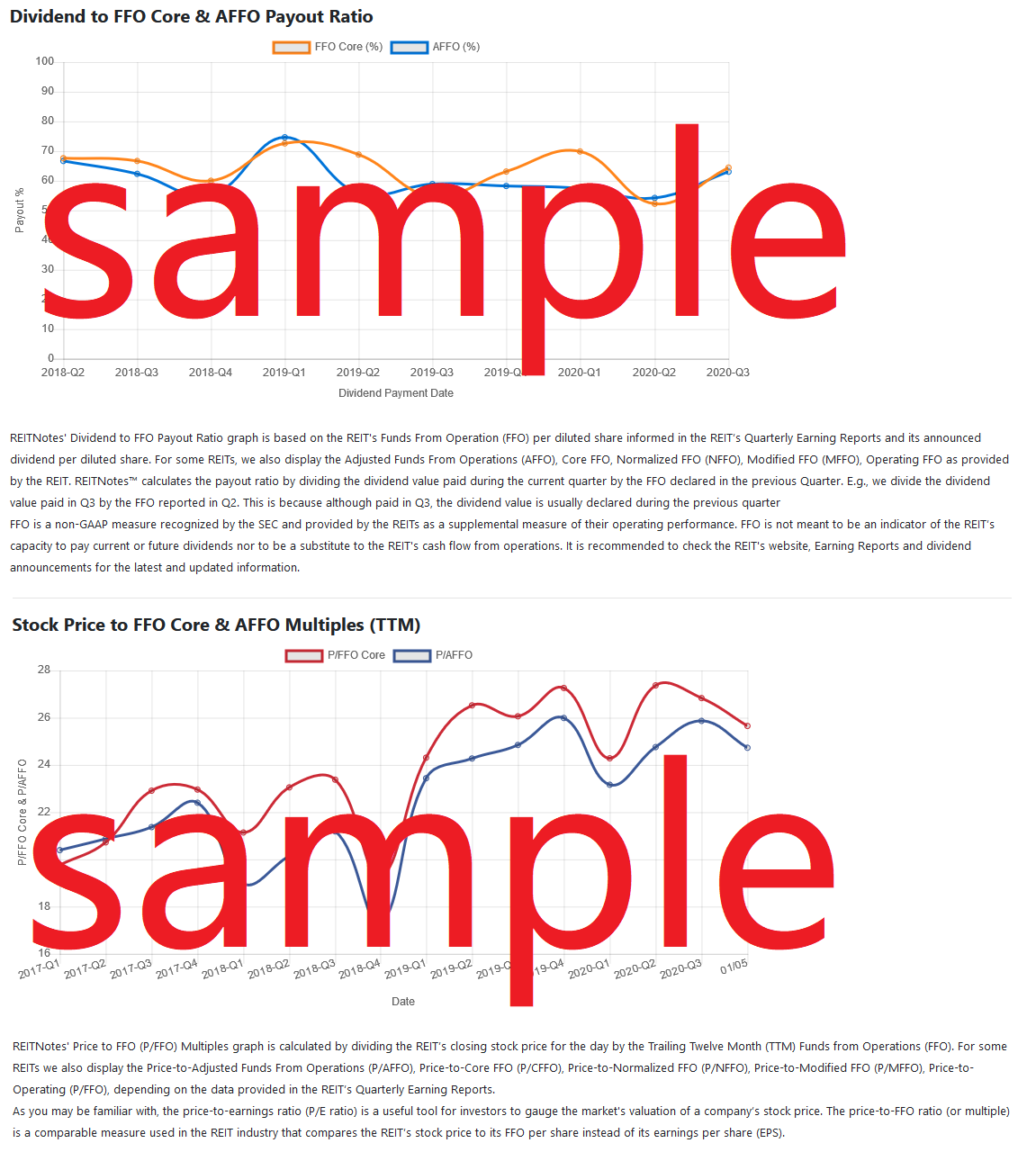

REITNotes uses the REIT's Funds From Operation (FFO) per diluted share informed in the REIT’s Quarterly Earning Reports and its announced dividend per diluted share. For some REITs, we also display the Adjusted Funds From Operations (AFFO), Core FFO, Normalized FFO (NFFO), Modified FFO (MFFO), Operating FFO as provided by the REIT. REITNotes™ calculates the payout ratio by dividing the dividend value paid during the current quarter by the FFO declared in the previous Quarter. E.g., we divide the dividend value paid in Q3 by the FFO reported in Q2. This is because although paid in Q3, the dividend value is usually declared during the previous quarter. FFO is a non-GAAP measure recognized by the SEC and provided by the REITs as a supplemental measure of their operating performance. FFO is not meant to be an indicator of the REIT’s capacity to pay current or future dividends nor to be a substitute to the REIT's cash flow from operations. It is recommended to check the REIT's website, Earning Reports and dividend announcements for the latest and updated information.

Key Stats of Trading Day 2025-04-17

EBITDA: $653,036,000

P/E Ratio: 17.64

PEG Ratio: 2.42

Book Value: 45.59

Dividend Per Share: $2.16

EPS: 1.77

Revenue Per Share TTM: $9.65

ProfitMargin: 18.60%

Operating Margin TTM: 30.60%

Return on Equity TTM: 4.10%

Revenue TTM: $1,135,629,000

Gross Profit TTM: $762,758,000

Diluted EPS TTM: $1.77

Quarterly Earnings Growth YOY: 24.90%

Quarterly Revenue Growth YOY: 6.50%

Trailing P/E: 17.64

Forward P/E: 26.39

Beta: 1.06

Price to Book Ratio: 0.69

EV to Revenue: 7.26

EV to EBITDA: 11.21x

Shares Outstanding: 118,269,000

52 Week High: $42.49

52 Week Low: $27.07

50 Day Moving Average: $33.50

200 Day Moving Average: $36.81

Properties Owned by KRC

Sample of REIT’s Properties. Image Source - REIT’s website

Occupancy Rate

REIT Simulation

Below is a simulation of how much money you would have made in dividends, and how much the shares would be worth had you purchased them 1 year ago for the amounts below.

| With $1,000 USD | With $500 USD | With $250 USD | With $100 USD | With $50 USD | |

|---|---|---|---|---|---|

| Initial investment | @ $80.99 per share you would have been able to buy 12 shares of KRC on 2024-04-18 costing $971.88 | @ $80.99 per share you would have been able to buy 6 shares of KRC on 2024-04-18 costing $485.94 | @ $80.99 per share you would have been able to buy 3 shares of KRC on 2024-04-18 costing $242.97 | @ $80.99 per share you would have been able to buy 1 shares of KRC on 2024-04-18 costing $80.99 | @ $80.99 per share you would have been able to buy 0 shares of KRC on 2024-04-18 costing $0.00 |

| Current worth | On 2024-07-05 these 12 shares would be worth $374.88 @ $31.24 | On 2024-07-05 these 6 shares would be worth $187.44 @ $31.24 | On 2024-07-05 these 3 shares would be worth $93.72 @ $31.24 | On 2024-07-05 these 1 shares would be worth $31.24 @ $31.24 | On 2024-07-05 these 0 shares would be worth $0.00 @ $31.24 |

| Dividends earned | $25.92 in dividends would have been earned since 2024-04-18 with 12 shares. | $13 in dividends would have been earned since 2024-04-18 with 6 shares. | $6.48 in dividends would have been earned since 2024-04-18 with 3 shares. | $2.16 in dividends would have been earned since 2024-04-18 with 1 shares. | $0.00 in dividends would have been earned since 2024-04-18 with 6 shares. |

| Net (gain / loss)* | -571.08 USD | -285.54 USD | -142.77 USD | -47.59 USD | 0.00 USD |

| ROI** | -58.76% | -58.76% | -58.76% | -58.76% | nan% |

*Net (Gains/Loss): Includes the stock price (appreciate or depreciate ) + dividends earned during period held. Stock prices based on closing price for the date. **ROI: Is based on the Net (gain/loss) divided by the initial investment value. Note: Past performance is no guarantee of future results. This is a high-level simulation and does not account for many factors such as inflation and taxes so we cannot guarantee the accuracy of this simulation.

Dividend History

Below are the most recent cash dividends paid by KRC. The percent difference from one dividend payment to the next has also been calculated for your convenience. Dividends flagged as [E] are extraordinary dividend payments.

| Symbol | Ex Date | Cash Amount | Change in Dividend | Declaration Date | Record Date | Payment Date |

|---|---|---|---|---|---|---|

| KRC | 2025-03-31 | 0.540 | --- | 2025-02-25 | 2025-03-31 | 2025-04-09 |

| KRC | 2024-12-31 | 0.540 | --- | 2024-12-05 | 2024-12-31 | 2025-01-08 |

| KRC | 2024-09-30 | 0.540 | --- | 2024-09-16 | 2024-09-30 | 2024-10-09 |

| KRC | 2024-06-28 | 0.540 | --- | 2024-05-22 | 2024-06-28 | 2024-07-10 |

| KRC | 2024-03-27 | 0.540 | --- | 2024-02-27 | 2024-03-29 | 2024-04-10 |

| KRC | 2023-12-28 | 0.540 | --- | 2023-12-06 | 2023-12-29 | 2024-01-10 |

| KRC | 2023-09-28 | 0.540 | --- | 2023-09-12 | 2023-09-29 | 2023-10-11 |

| KRC | 2023-06-29 | 0.540 | --- | 2023-05-24 | 2023-06-30 | 2023-07-12 |

| KRC | 2023-03-30 | 0.540 | --- | 2023-02-16 | 2023-03-31 | 2023-04-12 |

| KRC | 2022-12-29 | 0.540 | --- | 2022-12-07 | 2022-12-30 | 2023-01-11 |

| KRC | 2022-09-29 | 0.540 | 3.85% | 2022-09-08 | 2022-09-30 | 2022-10-12 |

| KRC | 2022-06-29 | 0.520 | --- | 2022-05-19 | 2022-06-30 | 2022-07-13 |

| KRC | 2022-03-30 | 0.520 | --- | 2022-02-08 | 2022-03-31 | 2022-04-13 |

| KRC | 2021-12-30 | 0.520 | --- | 2021-12-16 | 2021-12-31 | 2022-01-12 |

| KRC | 2021-09-29 | 0.520 | 4.00% | 2021-09-13 | 2021-09-30 | 2021-10-13 |

| KRC | 2021-06-29 | 0.500 | --- | 2021-05-20 | 2021-06-30 | 2021-07-14 |

| KRC | 2021-03-30 | 0.500 | --- | 2021-02-08 | 2021-03-31 | 2021-04-14 |

| KRC | 2020-12-30 | 0.500 | --- | 2020-12-10 | 2020-12-31 | 2021-01-15 |

| KRC | 2020-09-29 | 0.500 | 3.09% | 2020-08-26 | 2020-09-30 | 2020-10-14 |

| KRC | 2020-06-29 | 0.485 | --- | 2020-05-19 | 2020-06-30 | 2020-07-15 |

Financial Statements Overview

Balance Sheet | Quarterly

See Annual Balance Sheet | See Quarterly Balance Sheet

Income Statement | Quarterly

See Annual Income Statement | See Quarterly Income Statement

Cash Flow | Quarterly

See Annual Cash Flow | See Quarterly Cash Flow

REITRating™ Scorecard

| Rating | Dividend Section | Avg. Rating |

|---|---|---|

| 5 | Dividend Payment Growth: Analysis of how the REIT’s dividend payments have performed during the last three years. | 4.9 |

| 10 | Dividend Payment Consistency: Analysis of how many periods the REIT’s dividends have been paid consistently without a gap in payment. | 8.1 |

| 8 | Dividend to FFO Payout Ratio Health: Analysis of the REIT’s Dividend to FFO Payout Ratios during the last four quarters. | 9.0 |

| 5 | Dividend to FFO Payout Ratio Trend: Analysis of the REIT’s Dividend to FFO Payout Ratios trend during the last two years. | 7.5 |

| Rating | AFFO & Efficiency Section | Avg. Rating |

| 8 | FFO Trend: Analysis of the REIT’s FFO trend during the last two years. | 8.7 |

| 7 | FFO to Revenue Health: Analysis of the REIT's Adjusted Funds From Operation to its Revenues. | 6.8 |

| 8 | Operating Expense Efficiency: Analysis of the REIT's Operating Expenses to its Revenues. | 6.9 |

| 8 | Operating Expense Efficiency Trend: Analysis of the trend of the REIT's Operating Expenses to its Revenue. | 8.2 |

| Rating | Leverage Section | Avg. Rating |

| 9 | Interest Coverage Health: Analysis of the REIT’s Interest Coverage health during the last four quarter. | 5.9 |

| 7 | Interest Coverage Health Trend: Analysis of the REIT’s Interest Coverage health trend during the last two years. | 6.5 |

| 10 | Total Debt Interest Rate Competitiveness: Analysis of the REIT’s Interest Rate to Total Debt competitiveness compared to REIT market. | 7.8 |

| 4 | Total Debt Interest Rate Trend: Analysis of the REIT’s Interest Rate to Total Debt trend during the last two years. | 7.3 |

| 6 | Debt Leverage Health: Analysis of the REIT’s Total Debt to Total Assets. | 4.8 |

| 7 | Debt Leverage Health Trend: Analysis of the REIT’s Total Debt to Total Assets over the last two years. | 6.8 |

| Rating | Asset & Revenue Section | Avg. Rating |

| 8 | G&A Effeciency Level: Analysis of the REIT’s General and Administrative expenses in relationship to its Revenues. | 7.6 |

| 9 | G&A Effeciency Trend: Analysis of the Trend of the REIT’s General and Administrative expenses in relationship to its Revenues. | 8.4 |

| 5 | Revenues Growth: Analysis of how the REIT's Revenue has performed over the last two years. | 7.3 |

| 8 | Total Asset Growth: Analysis of how the REIT has grown its Total Assets over the last two years. | 6.4 |

| Rating | Properties Section | Avg. Rating |

| 6 | Occupancy Health Level: Analysis of the REIT’s occupancy health level during the last four quarters. | 7.8 |

| 4 | Occupancy Trend: Analysis of the REIT’s occupancy trend over the last two years. | 7.7 |

| 8 | Tenants: Analysis of the REIT's tenant diversification, operation type, and exposure to risk. | 8.1 |

| Rating | Market Cap Section | Avg. Rating |

| 5 | Market Cap Strength: Analysis of the REIT's Market Capitalization performance, preservation and resistance in comparison to market changes. | 5.0 |

| 7.0 | Overall REITRating™ Score (See trend) | 6.4 |

REITRating is REITNote's Real Estate Investment Trust industry-specific rating and ranking system. The REIT’s score for each analysis is out of ten points, with ten being the best score and zero being the worst. A score of zero can be assigned if the REIT does not meet the criteria for that specific analysis. N/A is assigned if insufficient data is available for a particular analysis. Our REITRating logic is continuously improving, so a REIT’s rating and ranking may change over time. Important Note: REITRating is not a predictor of a REIT’s future performance, it is an evaluation of its past results. Additionally, the REITRating system is for informational purposes only and does not represent financial or investment advice or a recommendation of which REITs to acquire. Learn more.

Related REITs

| REIT | REITRating™ Score | Exchange | Market Capitalization | Sector | Country |

|---|---|---|---|---|---|

| Equity Residential (EQR) | 8.4 | NYSE | Large-Cap | Residential | United States |

| Douglas Emmett, Inc. (DEI) | 5.7 | NYSE | Mid-Cap | Office Residential | United States |

| Pennymac Mortgage Investment Trust (PMT) | 4.6 | NYSE | Small-Cap | Mortgage | United States |

| Equity Commonwealth (EQC) | N/A | NYSE | Micro-Cap | Office | United States |

Last updated: 2025-04-18 - v5.8